Our Wealth Management & Financial Services

Wealth Management Services

We take a holistic approach to your current and future wealth management. We listen and understand your personal needs and what your goals are for the future.

LEARN MOREAged Care Financial Advice

Preparing the way for yourself or a loved one to enter residential aged care can be a difficult and stressful task. But you don’t have to face it alone. Getting advice can guide you through the process.

LEARN MOREWhat Makes Endura Private Wealth Different

Our Advisors Are Always Fiduciaries

That means our experienced & credentialed advisors are required by law to always act in your best interest. No exceptions.

We Build A Portfolio Just For You

We take a comprehensive approach to planning, which allows us to design a portfolio specifically suited to your personal financial situation.

Our Fees Are Simple & Transparent

Our financial advisors never earn commissions or hidden fees on your investments.

We Avoid Conflicts Of Interest

We never try to sell proprietary investment products. In fact, we don't even have them.

Endura Private Wealth's Investment Philosophy

Start Your Journey

Understand Your Needs

Peace of Mind

Endura Wealth Management News

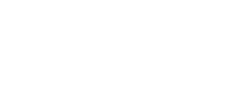

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex-and continuing to go it alone could prove costly in terms of investing miscues.

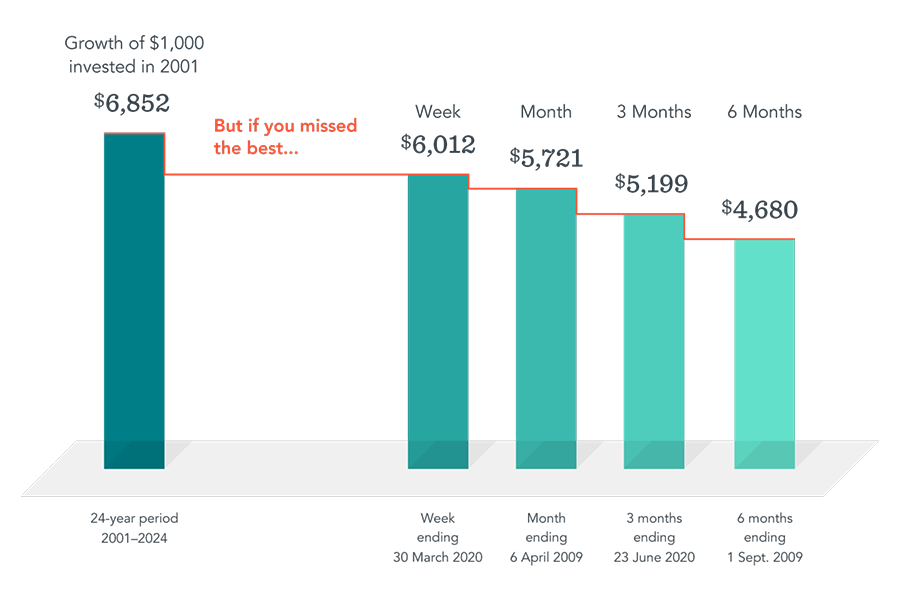

Compounding can help turn a small investment into substantial wealth. But to harness that power, the sooner you start, the better.

Markets took investors on an up-and-down ride during a volatile frst half of the year, with notable swings coming amid uncertainty about the impact of tariffs on the US and the global economy.

1300 628 071

1300 628 071