Archive for category: Investments

News

3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex-and continuing to go it alone could prove costly in terms of investing miscues.

... read moreMarket Review 2024: Stocks Overcome Uncertainty to Notch Another Strong Year

Financial markets showed resilience in 2024, extending the bull market that began in late 2022 as stocks weathered interest-rate changes, uncertainty around the US elections, and the ups and downs of the Magnificent 7 stocks.1 The S&P 500 posted a gain of more than 20% for the second year in a row-the first time that has happened since 1998-99.

... read moreExpressions of Interest

Recent interest rate cuts by central banks - in the US, the UK, Canada, New Zealand and elsewhere - have sparked speculation about when the Reserve Bank of Australia (RBA) will follow suit, as well as questions from investors about the implications for their bond portfolios.

... read moreMidyear Review: Stocks Maintain Momentum at Year’s Halfway Point

Investors who diversify, focus on the premiums, and embrace a flexible investing approach will still confront uncertainties in the year's second half. Uncertainty is unavoidable, and it accounts for the risk that can lead to positive returns.

... read moreClimate-aware investing

Most forecasters ignore the effects of climate change in their economic projections or long-term return expectations. Our return expectations - the building blocks of our strategic asset allocation - are now able to reflect the impact of climate change on the investing landscape.

... read more3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to go it alone could prove costly in terms of investing miscues.

... read moreFrom Skynet to ChatGPT: AI and Its Investment Implications

If you were to poll strangers on what comes to mind when they hear the term AI (artificial intelligence), the two most likely answers would be Skynet or ChatGPT. The history of AI tools is far older than ChatGPT, although less dramatic than its depiction in 1990s science fiction films. And from an investment standpoint, artificial intelligence pales in comparison to the informational content of the market’s AI— aggregate intelligence.

... read moreHow to Invest Better—and Live Better

It can be challenging to start a conversation about investing. That’s why I encourage having a conversation before the investing conversation—what I like to think of as a “preamble.” Connecting life principles to investment principles is a powerful way to ground abstract principles in reality, and to connect over universal experiences and feelings. It can also help make sense of investment concepts often dismissed as overly complex for those who aren’t familiar with them.

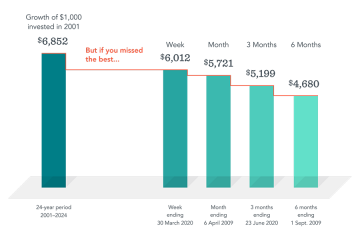

... read moreInvesting in a volatile market

Warren Buffet, arguably the world’s most successful investor, has long championed the 'buy-and-hold' investment strategy on quality stocks. It's a philosophy many aspire to, but history has shown that rarely do we have the patience.

... read moreInvesting for children

One of the world’s leading investors and philanthropist, Warren Buffet once said "A very rich person should leave his kids enough to do anything, but not enough to do nothing”.

It’s only natural that every parent, regardless of their financial position, wants the best for their children. So if you’re in a position to invest money specifically for your children’s future, you should consider your options carefully – just as you would if you were investing for yourself.

... read more

1300 628 071

1300 628 071