News

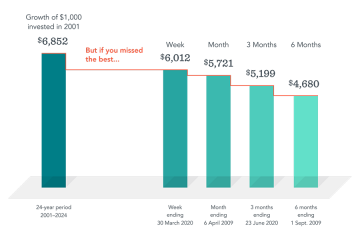

3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex-and continuing to go it alone could prove costly in terms of investing miscues.

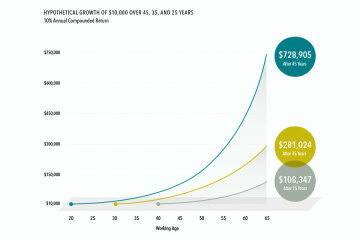

... read moreThe Power of Compounded Returns

Compounding can help turn a small investment into substantial wealth. But to harness that power, the sooner you start, the better.

... read moreMidyear Review: Stocks' Climb Is Challenged During Volatile First Half

Markets took investors on an up-and-down ride during a volatile frst half of the year, with notable swings coming amid uncertainty about the impact of tariffs on the US and the global economy.

... read moreFederal Election 2025: Key insights for you

The election results are in, with the Labor party re-elected. In addition to measures announced in the recent Federal Budget, a number of promises were made during the campaign which may impact clients and their finances if legislated. We've summarised some of the key announcements and what they could mean for the advice you provide.

... read moreMarket Review 2024: Stocks Overcome Uncertainty to Notch Another Strong Year

Financial markets showed resilience in 2024, extending the bull market that began in late 2022 as stocks weathered interest-rate changes, uncertainty around the US elections, and the ups and downs of the Magnificent 7 stocks.1 The S&P 500 posted a gain of more than 20% for the second year in a row-the first time that has happened since 1998-99.

... read moreUnravelling aged care fee changes

Aged care fees are set to change from 1 July 2025. For many people this may mean higher fees, but the aim is to ensure that aged care services improve and are more accessible.

... read moreExpressions of Interest

Recent interest rate cuts by central banks - in the US, the UK, Canada, New Zealand and elsewhere - have sparked speculation about when the Reserve Bank of Australia (RBA) will follow suit, as well as questions from investors about the implications for their bond portfolios.

... read moreWill I Pay More for Aged Care?

Changes to aged care fees are coming, and they will impact both home care and residential care.

... read moreWorried about ageing parents?

Life can be busy and complex for the ‘sandwich generation’ who find themselves stuck between caring for grandchildren and ageing parents. Most people are unprepared for aged care because let’s face it, no one wants to get old – but if we are lucky, we will.

... read moreWhat is the cost of university education in Australia?

One of the biggest questions many people have is, 'what is the average cost for university in Australia'? The cost of your degree will depend on the type of degree you're striving for. This article explores the cost of university education in Australia for a bachelor's degree, a master's degree including a Master's of Business Administration (MBA), and a doctoral degree.

... read moreMidyear Review: Stocks Maintain Momentum at Year’s Halfway Point

Investors who diversify, focus on the premiums, and embrace a flexible investing approach will still confront uncertainties in the year's second half. Uncertainty is unavoidable, and it accounts for the risk that can lead to positive returns.

... read moreClimate-aware investing

Most forecasters ignore the effects of climate change in their economic projections or long-term return expectations. Our return expectations - the building blocks of our strategic asset allocation - are now able to reflect the impact of climate change on the investing landscape.

... read more3 Common Investing Mistakes

Many people start out managing their own investments. But as their earnings and assets grow, their financial needs and challenges become more complex—and continuing to go it alone could prove costly in terms of investing miscues.

... read moreThe three phases of retirement

In our experience, new clients that we meet are needing more education around the full retirement experience (The Care Free Years / The Quiet Years / The Frailty Years). If the Frailty Years are forgotten, there is a risk that a person is left vulnerable and without adequate means to fund care. This may lead to a loss of independence and choice or reduce the quality of life in this phase.

... read moreFive financial moves to make in your 40s

Being in your 40s often involves balancing many responsibilities that it becomes easy to neglect your own financial wellbeing. But it’s not too late to secure your future. Here are some tips that may help you financially make the most of your 40s.

... read more2023: The Year that Wasn’t

Towards the end of the calendar year, there’s a natural tendency in the financial media to look both back and forward – back on the events of the past 12 months and forward to what we imagine the coming year will hold.

... read moreEducation Bond Case Studies

A look into how education bonds can be used to provide families the funds for children's education.

... read moreThe RBA says the fight against inflation has entered a new phase. Here's what it means for interest rates

Australia has entered a new frontier in its fight against inflation after the Reserve Bank left interest rates on hold at 4.1 per cent for the second month in a row at its August meeting.

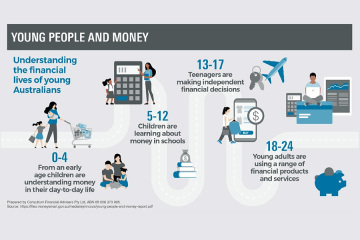

... read moreTeaching children healthy money habits

As a parent, you try to ensure your children have the skills to make smart financial decisions. For example, you tell them about the importance of saving or the power of compounding interest. But did you know that you could be sending them negative money messages without meaning to?

... read moreFrom Skynet to ChatGPT: AI and Its Investment Implications

If you were to poll strangers on what comes to mind when they hear the term AI (artificial intelligence), the two most likely answers would be Skynet or ChatGPT. The history of AI tools is far older than ChatGPT, although less dramatic than its depiction in 1990s science fiction films. And from an investment standpoint, artificial intelligence pales in comparison to the informational content of the market’s AI— aggregate intelligence.

... read moreMay 2023 Federal Budget

The 2023 Federal Budget focuses on providing cost of living relief through lower power bills, higher welfare payments and more support for small business and housing.

... read moreWhen Headlines Worry You, Bank on Investment Principles

On Friday, March 10, regulators took control of Silicon Valley Bank as a run on the bank unfolded. Two days later, regulators took control of a second lender, Signature Bank.

... read moreGovernment’s proposed changes to the taxation of super

The Government has announced that they intend to change to tax concessions on certain superannuation accounts if you have a total super balance of more than $3 million. While it is important to understand that this is just a proposal at this time, we understand that you may have some questions about whether this proposal could apply to you.

... read moreMarket Review 2022: After a Down Year, Looking to the Past as a Guide

It was an up-and-down year for markets—in the end, one with more down than up. The world gave financial markets a lot to process. This review provides some key takeaways about the 2022 market.

... read moreUpsize your retirement savings with downsizer contributions

The downsizer superannuation contribution provides an opportunity for eligible people aged 55 and over to sell their home and make a contribution to superannuation from the proceeds.

... read moreLegislation passes reducing downsizer eligibility age to 55

Legislation reducing the eligibility age to make a downsizer super contribution from 60 to 55 has passed and awaits Royal Assent. The commencement date is 1 January 2023 if Royal Assent is received prior to this date, otherwise it is likely to be 1 April. We will update you when the commencement date is confirmed.

Trust the Financial Advisor Who Trusts the Market

With over 200,000 fnancial advisors in the United States, how do you pick one? First, eliminate the stock pickers. Those are the people making predictions about which stocks are going to be winners and losers. Cross off the market timers, too. They’re the ones who get into and out of the market, trying to buy the dip and sell at the peak.

... read moreFederal Budget Oct 2022 summary

This year’s Federal Budget focuses on providing relief for those with children, homebuyers and social security recipients whilst maintaining pre-election commitments.

... read moreHow to Invest Better—and Live Better

It can be challenging to start a conversation about investing. That’s why I encourage having a conversation before the investing conversation—what I like to think of as a “preamble.” Connecting life principles to investment principles is a powerful way to ground abstract principles in reality, and to connect over universal experiences and feelings. It can also help make sense of investment concepts often dismissed as overly complex for those who aren’t familiar with them.

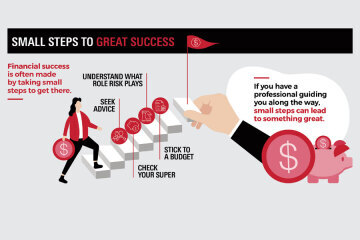

... read moreSmall steps to great success

Financial success is often made by taking small steps to get there. It may seem daunting and overwhelming but like anything, if you have a professional guiding you along the way, small steps can lead to something great.

... read moreLight at the End of the Inflation Tunnel?

It seems some investors have resigned themselves to a new normal of high inflation following decades of below-average consumer price changes. However, financial market data tells a different story, one of potentially softening inflation.

... read moreSuper Changes from 1 July 2022

Changes to super contribution rules from 1 July may create a great opportunity to revisit your savings and super contribution strategies. The changes may create new or enhanced options to build your savings.

... read moreEOFY Tips and Tax Return Checklist

To help you complete your tax return, including if you’ve been working from home, this checklist outlines income and expenses you need to disclose to the Australian Taxation Office (ATO) when lodging your return. We’ve also provided an overview of the types of tax offsets and deductions you may be entitled to claim plus other handy tax tips.

... read moreFour Ways to Improve the Probability of a Good Retirement

Around the world, individuals are being asked to take on greater responsibility for their own retirement.

... read more2022 Federal Budget Analysis

This year’s Federal Budget covers a range of measures aiming to reduce the pressure from increased costs of living and help people into homes.

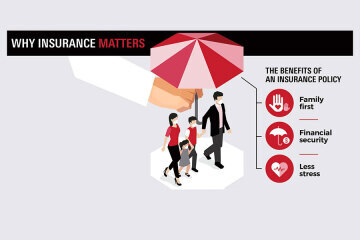

... read moreWhy does insurance matter?

Having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

... read moreFive tips for looking after your household’s finances

Take the pain out of managing your family’s finances with some simple tips every family can use.

... read moreA new year is a chance for a fresh start

New year is a great time for making lifestyle changes, however, for goals and changes affecting your financial health, there's often no better time than when starting a new job.

... read moreKey Questions for Long-Term Investors

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you’ll likely ask yourself some of the questions in this article.

... read moreWhat to Expect in my First Financial Advice Meeting

When you haven't done something before, you can be nervous. When it comes to your first Financial Advice meeting at Endura we want you to be clear on exactly what's going to happen. Watch this video to find out more.

The True Value of Advice - Confidence Delivers

Confidence helps you get more out of life. A recent landmark survey found that for clients who received financial advice, they were free from financial stress. And when you're not stressed, you live a better life.

11 Tax Facts about Superannuation

Compared to other investment structures, super is widely considered to be one of the most tax-effective investment structures available from a wealth accumulation and cash flow generation perspective. Although not a comprehensive list, below are 11 of the top tax facts about super.

... read moreHow do you know when the advice is right?

Seeking financial advice can turn your life around and put you on a path to a happier and more secure financial future. But where do you start? Who do you trust? How do you know you are going to get value for money?

... read moreNavigating your way through a redundancy

The Australian Bureau of Statistics announced a record 932,000 jobs were lost between the March and June 2020 quarters in the wake of COVID-19. While the Government extended temporary economic assistance for most businesses until March 2021, it has gradually been phased back which may result in many businesses downsizing, winding up or becoming bankrupt. This means it’s possible that more jobs may be lost in the coming months.

... read moreHow will the Federal Budget affect you?

During this year’s Federal Budget announcement Treasurer Josh Frydenberg stated “Australia is back!”. The Budget proposes positive changes to superannuation, an extension of the low and middle income tax offsets and a boost to aged care services.

... read moreWhy Insurance Matters

In a year that has seen so many unexpected events take place it is top of mind for most Australians now more than ever that life does not always go the way we plan, but having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

... read moreUpdate on the housing market

Last May we discussed the likely impact of the Coronavirus on the Australian property market and concluded that the pandemic will place downward pressures on the general level of house prices by either reducing demand or increasing supply.

... read moreWhat financial mistakes have you made?

Have you made a big financial mistake in the past? One that cost you a lot of time and money to fix? One that caused you a big headache?

... read moreFive ways to stick to your financial resolution

Setting a financial goal for the New Year? Take steps to make it work.

... read moreEndura Private Wealth is 100% committed to the BFO

Endura Private Wealth is 100% committed to the Banking and Finance Oath that re-asserts the ethical foundation of the industry.

... read more

1300 628 071

1300 628 071