News

Advisers exceed expectation of 95% of clients

Most (90%) of advised clients are left in a better financial position after accessing financial advice and 95% thought their adviser always met or exceeded their expectation, according to a survey.

... read moreHow To Choose A Top Financial Adviser

Many people don’t consider consulting a financial adviser until they are close to retirement. However, for the best chance for financial independence in your retirement, the earlier you start working on your financial plan, the better.

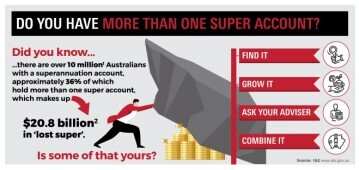

... read moreDo you have more than one super account?

Did you know there is over 101 million Australians with a superannuation account, approximately 36% of which hold more super accounts, which make up $20.82 billion in ‘lost super’. Is some of that yours?

... read moreThe Pizza Pandemic

The global pandemic wrought by COVID-19 has created great uncertainty among policymakers, investors, workers and consumers, but it’s worth noting that its repercussions on the economy and the share market have not been all in one direction.

... read moreTake control of your retirement

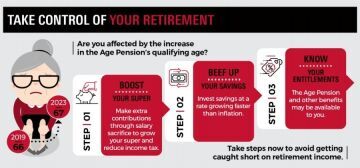

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income.

The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age increases by six months every two years until it reaches 67 in July 2023. It rises to 66 in July this year.

... read moreFive tips for looking after your large household’s finances

Taking care of household finances can be taxing, especially if you have a big family. But with proper planning and budgeting, there’s no need to stress.

Here are some tips to help you effectively manage your household finances.

... read moreLess for longer: Extension of JobSeeker and JobKeeper Payments

On 21 July 2020 the Government announced a range of proposals to the JobKeeper and JobSeeker Payments as existing arrangements are set to expire in late September 2020. Certain tax concessions to assist businesses were also extended and have been legislated.

... read moreGet Insurance while you're still bulletproof

According to research by TAL insurance provider the cost of personal insurance soars after the age of 35. This is also the time in our lives that you may be going through significant change such as marriage, children, a bigger mortgage and more responsibilities.

... read moreThe Dangers of DIY Trading

Many people have taken advantage of the coronavirus lockdown to learn new skills—from baking bread, to knitting, to learning a language. But trading securities, like rewiring the house, is not something you should do without professional advice.

... read moreDo Downturns Lead to Down Years?

Stock market slides over a few days or months may lead investors to anticipate a down year. But a broad Australian

market index had positive returns in 15 of the past 19 calendar years, despite some notable dips in many of those years.

COVID-19 update

Updates that we feel you need to be aware of about our office, the investment market, and how to get through 2020.

... read moreHelping your children, financially speaking

As a parent you probably have great expectations for your child. They will have everything you had and more! You will consider their every need and make the most of every opportunity to help them get ahead, right?

Whilst every parent wants their child to be healthy, happy and financially secure, figuring out how to get them there is another thing. Working with a financial adviser can help you understand options available to financially help your children, and teach them how to take control of their financial future once it is time for you to step out of the equation, and them to step up. Introducing these discussions as a family from early on means you can get help for your children that will serve them well into their future.

... read moreDownsizing when you retire

Many retirees consider ‘Downsizing’ their home at some point. This is often for financial reasons (as the current home may now be too big) or to move into a new house better equipped to accommodate them. Over the last few years, Endura Private Wealth has specialised in providing guidance on ‘Downsizing’ for residents from Malvern to Prahran and Caulfield to Glen Iris.

... read moreChanges to income protection insurance

Also known as ‘salary continuance insurance’ or ‘disability income insurance’, income protection provides a portion of your income, for example 75% of your annual salary, if you are unable to work due to injury or sickness for a certain period of time. You need to advise your annual salary when you take out the cover.

Income protection policies always have a waiting period and a payment period. The waiting period is the time you must wait from when you make a valid claim, to the time you become eligible to start receiving payments. The payment period is the period you can be paid so long as you remain unable to work. Other terms and conditions apply depending on the policy. All of these factors affect the level of premiums you pay.

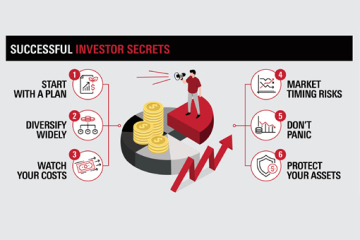

... read moreSuccessful Investor Secrets

The investment world can change dramatically from one month to the next. But these secrets of successful investors never go out of style.

Successful investing can be one of your biggest allies in the quest for long-term financial security. Unfortunately, unsuccessful investing can leave you wishing you’d kept your money in the bank.

... read moreHindsight is 20/20. Foresight Isn't

The year 2019 served up many examples of the unpredictability of markets.

Download and read this article issued by DFA Australia Limited (AFS Licence No. 238093. ABN 46 065 937 671). Material provided for information only.

... read moreTaking the mystery out of the jargon

When it comes to super, all too often it can seem to be in another language. But when you understand the language, everything starts to make a lot more sense. To help, we explain some commonly used superannuation jargon.

... read moreAll I want for Christmas is to survive debt free!

Christmas is just around the corner and it’s easy to get caught up in the festivities of the season. Unfortunately this can be bad news for your finances. After a year of careful spending don’t let Christmas blow your budget. Follow these tips and emerge in the New Year without the financial hangover.

... read moreTrue value of advice

There’s plenty to consider when trying to secure your financial future. Should I pay off the mortgage or put money into super.... but what about renovations? When can I stop work? How do I afford the children’s education?

... read moreMeeting your future lifestyle needs

Whether you’re at the beginning of your working life, have been working for a number of years, or already enjoying your retirement, professional financial advice can make a difference when it comes to achieving your financial goals and meeting your future lifestyle needs.

... read moreInvesting in a volatile market

Warren Buffet, arguably the world’s most successful investor, has long championed the 'buy-and-hold' investment strategy on quality stocks. It's a philosophy many aspire to, but history has shown that rarely do we have the patience.

... read moreSalary sacrificing - not such a sacrifice

A global survey of people's attitudes to retirement savings shows while Australians expect to spend, on average, 23 years in retirement, their money will run out after only just 10 years. This gap in retirement savings, affectionately called ‘the retirement gap’ is a growing concern and more and more Australians are looking for ways to boost their super savings.

... read moreATO diversification probe may cause audit headaches

Some SMSF trustees with annual returns due in October may need to re-audit their accounts for the last financial year, following a warning from the ATO that funds which are highly concentrated in one asset must present a compliant investment strategy to their auditor or risk penalties of over $4,000.

... read moreFirst steps to building your wealth

Looking for the most effective way to build your wealth? Not sure where to start? The first thing you need to do is determine your needs and goals, both short and long term.

... read moreSecond marriage - what are the estate planning implications?

Getting married is a joyous time. However, if you are one of the 20 per cent of Australians who will do so a second (or more!) time, children from a previous marriage can present complex estate planning challenges.

... read moreGoing overseas? Don't forget to tell Centrelink

Many people look forward to the opportunity to enjoy their retirement by travelling overseas. For some, it means they plan to live overseas on a permanent basis so they can take advantage of lower living costs while for others it may mean reuniting with relatives who live overseas.

... read moreWhat is the value of an Adviser?

A new report has dived into the value of advisers and found that they deliver value of at least 4.4 per cent or more every year to their clients beyond investment-only advice.

... read moreMake the right retirement living choice

Many of us save and plan for retirement, with our main focus on ensuring we have enough money to live the type of lifestyle that we want. Although this is an important aspect of planning ahead, another key consideration is planning where we will live during our retirement.

... read moreFurther Information

Following our update from last week, we would like to provide you with further information on the business changes to take place shortly.

We are excited to announce that from the 1st August 2019 knp Financial Services will be changing our name to Endura Private Wealth.

... read moreInvesting for children

One of the world’s leading investors and philanthropist, Warren Buffet once said "A very rich person should leave his kids enough to do anything, but not enough to do nothing”.

It’s only natural that every parent, regardless of their financial position, wants the best for their children. So if you’re in a position to invest money specifically for your children’s future, you should consider your options carefully – just as you would if you were investing for yourself.

... read moreAn exciting new development

knp Financial Services (knpFS) are now ready to share an exciting development for our business. From 1 August 2019, knpFS will operate as an independent entity, which will see our firm relocate, rebrand and regenerate our service offering.

... read moreUncovering the mystery of tax on super

The rules regarding super and tax are complex and, for many, the tax paid when putting money into super, its earnings while invested, and when benefits are finally paid can be a mystery. We take a look at how superannuation is taxed.

... read moreSmart ways to give

Choosing to give money to charity or charitable causes that you care passionately about can be straightforward but there are several different ways you can give.

... read moreMythbusting insurance

Most people wouldn’t dream of taking their car on the road without car insurance, or living in a house without home and contents insurance. But when it comes to taking up insurance to protect their life or income, most Australians act indifferently.

... read moreCan your Will be challenged?

Yes it can, but only in certain situations. While most people try hard to strike a fair balance when they write their Will, sometimes there may be people who are unhappy with how the estate has been divided and decide to challenge it.

... read moreHow to find the right financial adviser for you

When it comes to getting financial advice, it's imperative to find someone you trust.

But with the financial services royal commission revealing a culture of greed in the financial advice industry, it's hard to know where to turn for advice.

... read moreIs debt ruling your life?

Student loans, credit cards and personal loans can be helpful at the time, however often become a source of unnecessary stress later on.

Clearing your debts doesn’t have to be hard work. With the right plan, it’s possible to get your finances on track sooner than you think - and back to living the good life, guilt-free. Here are some tips to help you get out of debt.

... read moreGoing overseas? Don't forget to tell Centrelink

Many people look forward to the opportunity to enjoy their retirement by travelling overseas. For some, it means they plan to live overseas on a permanent basis so they can take advantage of lower living costs while for others it may mean reuniting with relatives who live overseas.

... read moreAged care - part of your plan

It can be difficult to plan, both financially or emotionally, for the move into an aged care facility. When choosing the best care as a part of your retirement – or for loved ones – many practical issues arise and decisions need to be made. It’s important to know what’s involved and have the confidence to face the challenges of aged care. Here are some tips to get you started:

... read moreMoney doesn't grow on trees

Children certainly don’t come with an instruction manual. From the time they’re learning to crawl parents begin teaching their children about right and wrong, personal safety, manners and morals. Over time, children are taught about stranger-danger, healthy eating and personal accountability. Interestingly however, many Australian parents leave out one of the most important survival skills their children will need in the future - how to take care of themselves financially.

... read moreSpotlight on SMSFs

Australians who want greater control of how their retirement savings are invested are increasingly exploring the option of setting up their own self-managed super fund (SMSF). The freedom of putting yourself in the driver’s seat for your super has made SMSFs the fastest growing sector of the super industry.

... read moreBanking Royal Commission

We at knp Financial Services welcome the public release of the Royal Commission’s Final Report and we are currently undertaking a thorough review of its recommendations and how this may impact you.

... read moreNew job resolutions

Birthdays and new years are great times for making lifestyle changes, however, for resolutions affecting your financial health, there’s often no better time than when starting a new job.

... read moreWhat really influences interest rates?

Interest rates are very important for many Australians, and rightly so – after all, whether it's the returns on savings accounts or mortgage repayments, the rate of the day can have a significant impact on the household budget for millions of Australians. So what influences interest rates, and why are they changed?

... read more

1300 628 071

1300 628 071